No Tax On Tips Act 2025: A Comprehensive Guide for Employees and Employers

The prospect of a “No Tax On Tips Act” in 2025 has sparked considerable debate and speculation. While no such act currently exists, the idea of eliminating or significantly reducing taxes on tips received by employees is a recurring theme in political and economic discussions. This comprehensive guide aims to explore the potential implications of such a hypothetical act, examining its potential benefits and drawbacks for both employees and employers.

Understanding the Current Taxation of Tips

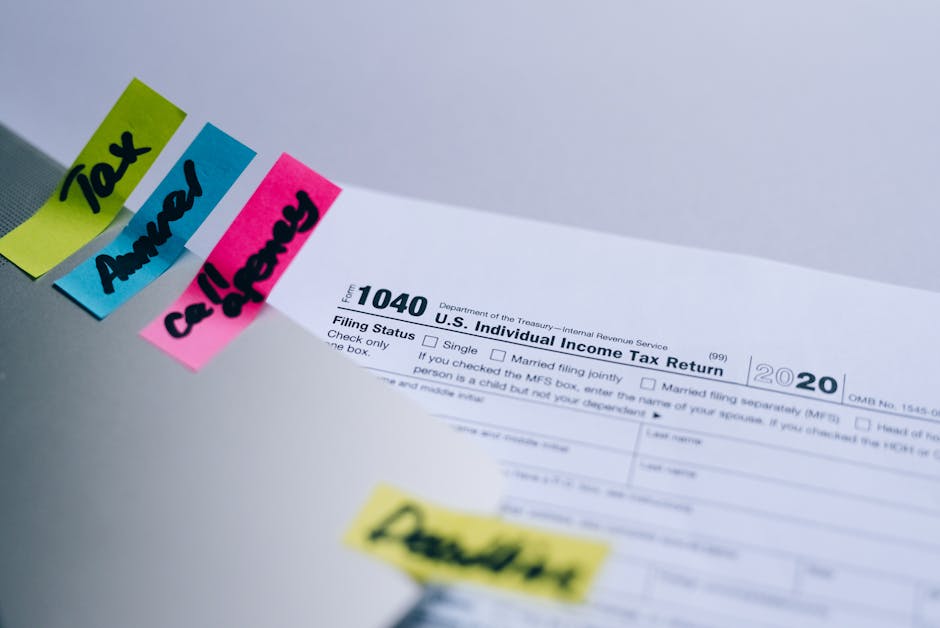

Before delving into a hypothetical “No Tax On Tips Act 2025,” it’s crucial to understand the current tax treatment of tips in various jurisdictions. In many countries, tips received by employees are considered taxable income. This means that employees are responsible for reporting their tip income to the relevant tax authorities, often through various methods such as self-reporting on tax returns or through employer-provided systems where employers collect and report tips on behalf of their employees. Failure to report tip income accurately can lead to penalties and back taxes.

The complexities of tip reporting can vary considerably depending on the industry, employment structure (e.g., independent contractor vs. employee), and the size of the employer. Some employers may use tip pooling systems, where tips are collected and distributed among employees. The tax implications of these systems can be intricate and require careful attention to legal compliance.

Hypothetical Implications of a “No Tax On Tips Act 2025”

A “No Tax On Tips Act 2025”, if enacted, would significantly alter the current tax landscape. The most immediate impact would be the elimination or reduction of income tax on tips. This could have several consequences:

Potential Benefits for Employees

- Increased Disposable Income: Employees would receive their full tip amount without any tax deductions, leading to a significant boost in their take-home pay.

- Improved Financial Stability: This could particularly benefit low-wage earners who rely heavily on tips to supplement their income, providing enhanced financial stability.

- Incentivized Excellent Service: The prospect of keeping their entire tip amount might encourage employees to provide even better service, leading to increased customer satisfaction.

Potential Drawbacks for Employees

- Reduced Social Security and Medicare Contributions: If tips are not subject to payroll taxes, employees would not contribute towards Social Security and Medicare benefits. This could have long-term implications for their retirement security and healthcare coverage.

- Increased Reporting Complexity: While the act might eliminate income tax, it could still necessitate rigorous record-keeping to ensure accurate reporting for other purposes, such as unemployment insurance or workers’ compensation claims.

- Potential for Abuse: Without stringent regulations, employers might attempt to underreport wages and rely more on tips, potentially leading to employee exploitation.

Potential Benefits for Employers

- Improved Employee Morale: The potential for increased employee income could boost morale and improve overall workplace productivity.

- Reduced Administrative Burden: Eliminating tax withholding on tips could simplify payroll processing and reduce administrative costs for employers.

Potential Drawbacks for Employers

- Increased Labor Costs (Indirectly): While direct tax burdens might be reduced, employers might face higher overall labor costs due to increased competition for employees in a scenario where workers receive higher net pay.

- Potential for Increased Regulatory Scrutiny: A “No Tax On Tips Act” could necessitate greater regulatory oversight to prevent potential abuses and ensure fair labor practices.

Economic and Social Implications

The enactment of a “No Tax On Tips Act 2025” would have wide-ranging economic and social consequences. The potential impact on income inequality, the effect on government revenue, and the overall impact on the service industry would require careful consideration and analysis. A comprehensive cost-benefit analysis would be essential to evaluate the long-term impact of such a policy change.

Conclusion: The Need for Careful Consideration

The idea of a “No Tax On Tips Act 2025” presents a complex scenario with both advantages and disadvantages for employees, employers, and the wider economy. Any such legislation would require a thorough understanding of its potential effects and the development of robust regulatory mechanisms to address potential challenges. The future of tipping and its taxation remains a dynamic area requiring ongoing debate and careful consideration.

Future of Tipping and Taxation

It is crucial to monitor legislative developments regarding tip taxation. The concept of a “No Tax On Tips Act” may evolve, or similar legislation might be proposed in the future. Staying informed about these developments will be essential for both employees and employers in the service industry and beyond.