The Ongoing Debate: Taxation of Tips

The question of whether the Senate has passed legislation eliminating taxes on tips is a recurring one, often fueled by misinformation and misunderstanding. The reality is far more nuanced than a simple yes or no answer. While there have been various proposals and discussions regarding tip taxation reform, no legislation has been passed at the federal level that completely eliminates the taxation of tips received by employees. This article will delve into the complexities of tip taxation, addressing common misconceptions and clarifying the current legal landscape.

The Current State of Tip Taxation in the US

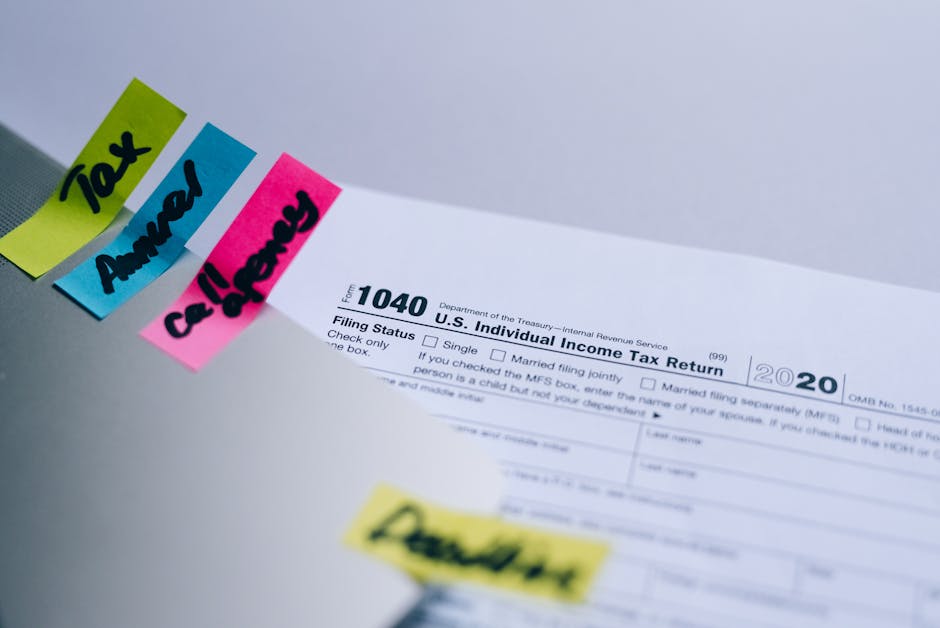

In the United States, tips are considered income and are subject to both federal and state income taxes. This means that employees who receive tips are responsible for reporting this income to the Internal Revenue Service (IRS) and their respective state tax agencies. There are specific procedures and forms involved in accurately reporting and paying taxes on tips, often requiring meticulous record-keeping and careful calculation.

The IRS provides detailed guidelines on how to report tip income. Employees generally use Form W-2 to report wages and Form 1040 to report income, including tips. However, the complexity arises from the various ways tips are reported. Some employers directly report a portion of tips to the IRS, often based on estimates or employer-provided reports, but the employee ultimately remains responsible for reporting their actual tip income accurately. Failure to do so can lead to penalties and interest from the IRS.

Common Misconceptions and Myths Surrounding Tip Taxation

Many myths surround tip taxation, leading to confusion and potential non-compliance. One common misconception is the belief that tips are inherently tax-free. This is unequivocally false. Another misconception is that only cash tips need to be reported, while credit card tips are automatically handled by the employer. While credit card tips are often tracked by the employer and reported to the employee, the employee remains ultimately responsible for reporting all tips accurately.

Furthermore, some believe that if the employer doesn’t explicitly track tips, the employee has no obligation to report them. This is incorrect. The employee is responsible for accurate reporting, regardless of the employer’s record-keeping practices. The IRS can still determine tip income through various means, even if the employer hasn’t reported them. Finally, the belief that a ‘no tax on tips’ bill has been passed at the federal level is a frequent and inaccurate statement.

Proposed Legislation and Ongoing Debates

While there hasn’t been a successful federal bill to eliminate tip taxes, there have been various proposals and ongoing debates surrounding tip taxation reform. These often focus on simplifying the reporting process, addressing discrepancies between reported and actual tip income, and providing more clarity for both employees and employers. Some proposals involve adjusting the way credit card tips are handled, improving employer reporting mechanisms, or exploring alternative methods of taxation that are less burdensome for workers.

However, these proposals face significant challenges, including concerns about revenue loss for government entities, the complexities of accurately tracking and reporting tips across different industries and business models, and the potential for increased compliance burdens on businesses.

The Importance of Accurate Tip Reporting

Accurate reporting of tip income is crucial for several reasons. Firstly, it ensures fair tax compliance and prevents legal repercussions, including penalties and potential audits. Secondly, it contributes to the overall fairness of the tax system. Thirdly, it protects workers from being unintentionally underpaid or facing future tax discrepancies. Accurate tip reporting fosters a transparent and equitable tax system for everyone involved.

Understanding Your Responsibilities as a Tipped Employee

As a tipped employee, you have several key responsibilities concerning tip reporting. These include keeping meticulous records of all tips received, both cash and credit card, understanding the relevant tax forms, and accurately reporting your income to the IRS. Seeking professional advice from a tax advisor or accountant can help ensure compliance and minimize potential issues.

Resources and Further Information

The IRS website provides comprehensive information on reporting tip income, including forms, instructions, and frequently asked questions. It is essential to consult these resources for accurate and updated information. Additionally, seeking guidance from a tax professional can provide personalized advice and ensure compliance with current tax laws.

Conclusion: No Federal Elimination of Tip Taxes

In conclusion, the claim that the Senate has passed legislation to eliminate taxes on tips is factually incorrect. While there have been ongoing discussions and proposals regarding tip taxation reform, no such legislation has passed at the federal level. Tips remain taxable income, and it is crucial for tipped employees to understand their responsibilities in accurately reporting this income to avoid potential legal and financial consequences. The focus should remain on improving the reporting system for both employers and employees, ensuring fairness and clarity for all parties involved.